Have you done your first quarter business review? Or are you thinking – wait, what? The first quarter is over? Maybe if you ignore it, it will go away.

So, this is your conscience speaking. Time to check in on your business or your personal business goals. Have I done mine yet? Well, no, but then I recall one of my father’s favorite southernisms.

Do as I say, not as I do.

Put away your excuses. And I will put away mine.

Quarterly Business Review: Money and Operations

If nothing else, at least think about what happened during the first quarter. Here’s a simple place to start.

Think about what specific areas you review, such as the examples listed below. Tweak the list to what works best for you.

- Sales, marketing

- Clients, prospects, leads

- Accounts payable, accounts receivable

- Supplies, inventory, vendors

- Salaries/compensation, recruiting

The list can be as concise or complex as you want it. It can be overwhelming so let’s scale it into manageable chunks (that’s a technical business term). 😉

A business review boils down to three categories – Money In, Money Out, and Operations.

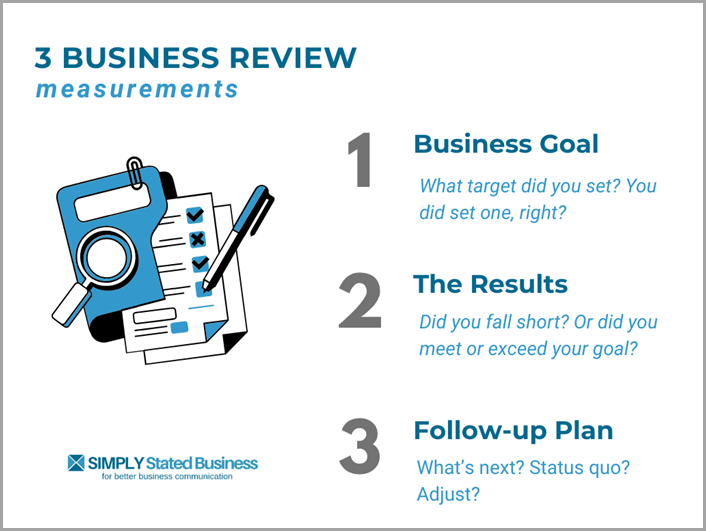

Write down your responses to the three measurements illustrated below.

If you have not set targets for measurement, you can approach it in one of two ways.

- Set your targets now before doing your review.

- Evaluate your first quarter results and then set goals.

Do you feel good about your results so far? If not, plan accordingly.

Money In

I love all things simple – especially math. So, try on the calculation below for size.

Money-in Calculation: What money have you received for your products or services?

Next, ask the following questions.

- What is your sales or income target?

- Did you fall short? Meet target? Exceed target?

- What are you going to do as a result?

The last question sets the plan for the next quarter. The following are a few ideas to consider.

- Do you have pending invoices?

- Are there billing or collection issues?

- What do your prospects/leads look like?

- How can you increase sales?

Money Out

Have you ever noticed that you always know how much money you receive?

Unfortunately, some of us pay less attention to the money going out. It’s like playing the game of not opening a bill. It doesn’t exist if we don’t see it, right?

Great sales means nothing if you spend more than you receive.

Writer friend, Anne Wayman, had a simple method to use when you have no idea what you spend.

- Track every penny.

- Do it for at least 30 days.

- Check results – they may surprise you.

Take your results and set a target.

- What is your target for expenses?

- Did you spend less? Stay on target? Exceed budget?

- What are you going to do as a result?

Consider the following.

- Is your budget realistic?

- Are there areas you can cut back on?

- Do you have higher expenses coming up?

Operations

Operations are the activities you or your employees perform to run your business. For example, marketing and customer service are part of your operations.

In my corporate management days, I tried to impress on my employees that all of operations is involved in sales.

- Customer service makes a lasting impression.

- Internal training promotes better products and service.

- Every employee represents the company’s brand.

Efficient operations support better sales.

So, whether you are a company of one or thousands, set goals for operations.

- What are your operations goals for each category?

- Did you fall short? Meet target? Exceed target?

- What are you going to do as a result?

Nailing Your Review

A quarterly review is good business. You find what’s working and what’s not so you can adjust what you’re doing for better results. Look at…

- Money In

- Money Out

- Operations

Do you do a quarterly review? If so, what do you review?

Note: This is an update to the original post that published on April 2, 2012.

Credit: Bigstock Photo

Credit: Canva

Ah, jeez. I’m sure I should do this…I’m sure I *could* do this…but then I’d lose my title of World’s Randomest Freelancer and that would be a downright shame.

*slinking off guiltily*

Hey, who am I to mess with success, Jake? 😉

I’m not doing this, but I should. My excuse? “It’s not my full-time job.” I know, lame excuse. Thanks for the reminder, Cathy.

That’s a good one, Wade. And actually it’s a good point. The first question should be what do you want from your freelance writing business? Then you know how to set targets – or not. 🙂

Thanks for sharing that, Wade.

I do a good job at tracking income, but I’m not so good at tracking outgo. That’s in part because I generally make significantly more than I spend, and I have savings, and I’m a fairly frugal person.

One thing I am doing more is long-term financial planning. The big unknown? Health-care costs.

Good advice, Cathy. I’ve recently switched to a proper accounts package and I am trying to be rigorous about tracking outgoings. You’re right – the results can be surprising.

Hi John: I figure since I try to keep up on expenses for tax purposes anyway, it’s not that much of a stretch to track it. I have an accordion folder for receipts by month and I spreadsheet them.

Theoretically, I enter new ones every Friday, but that doesn’t happen all the time. The quarterly review is another way to kick me in the rear so I don’t have such a huge task come tax time.

I have a spreadsheet for my quarterly review, too, with categories for Income, Expenses, Marketing, and Learning.

And I so understand about the health care dilemma. 🙂 Thanks, John, for sharing your thoughts.

Hi Sharon: I haven’t gone the accounts packaging yet, but do consider it. For now, my Excel spreadsheet works for me. Thanks, Sharon. Let us know how it goes.

Cathy- I read the post AND the comments.

Yes, it may not be your full time job- but if you don’t generate profits 3 out of 5 years, it is a very expensive hobby- since your revenue will be taxed, but your business expenses will be negated (under IRS regs). And, if it just a sideline- how do you know if you it’s not costing you money? (I have clients who show me their back of the envelope calculations demonstrating “profits” that miss so many of their expenses, I’m surprised their spouses have not shot them!)

Hey Cathy, I have started doing a quarterly (and annual) review of “money in and money out” along with overall goals, action items, accomplishments, next quarter’s goals, etc. 🙂

Not to mention I do a monthly review of finances as well (personal and business).

This is great info and I’m hoping others do the same as it can only help make a business very successful. It helps to know what was previously done to help plan for the future!

~Kesha

Excellent point, Roy. So, who knew that a quarterly review could also be life-saving? 🙂

Sounds like you really have it together, Kesha. I’m like you and also do a review monthly of the money. It can be very motivating. 🙂

Thanks for sharing your system, Kesha.