Have you checked out positions placed by LinkedIn job posters? Did you find the perfect fit or did the description fail to match the title?

Have you checked out positions placed by LinkedIn job posters? Did you find the perfect fit or did the description fail to match the title?

- A well-crafted job posting helps companies find the ideal candidate.

- A good match relies on the words used to describe requirements and expectations.

- The position title is the hook that snags the candidate’s attention.

But there is one word that LinkedIn job posters and hiring companies continue to misuse – Freelance.

LinkedIn Job Poster Problem

I originally wrote this post in 2014. At the time, I was surprised to see how frequently the word freelance (or freelancer) popped up in job listings.

- This was long before a global pandemic had nearly everyone working remotely.

- In fact, most companies resisted the idea of remote work.

- So, I was skeptical that so many companies were hiring freelancers.

If companies didn’t like the loss of control with remote work, why would they hire freelancers? They would have even less control on how an independent contractor worked.

As it turns out, my skepticism was well placed. What I found was most of the ads described jobs that crossed the line from freelancer independence into employee status.

Must work onsite

Writer will work out of our New York location

Writer must be available for all shifts

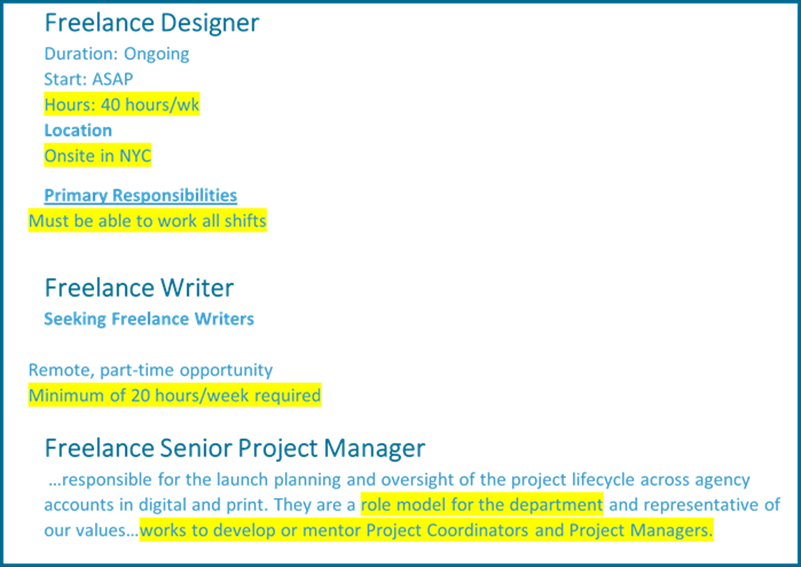

In the aftermath of pandemic chaos, I wondered if LinkedIn job posters continued to misuse the word freelance. Look at the following excerpts and you will get your answer.

While you may be able to stretch the last ad to be more “freelance-friendly,” it tiptoes into the who is in control issue. That’s a red flag in the Internal Revenue Service’s (IRS) independent contractor definition.

What’s the Big Deal?

So job posters use the wrong word when they mean something else. No big deal, right? You may want to think again.

Yes, companies experience financial gains when working with an independent contractor (versus an employee).

- No need to withhold income taxes,

- And no costly employee benefits.

However, mistakes are made in labeling workers as independent contractors.

- Inaccurate classifications cost millions in lost federal taxes each year,

- An estimated loss of $3,710 in employment tax for each misclassified worker.

- You know that gets the attention of the IRS.Something no employer wants to do.

Job Poster Word Test

So, the IRS provides a guide in determining if an individual qualifies as an independent contractor. Check out the Internal Revenue Service’s (IRS) Independent Contractor (Self-Employed) or Employee?

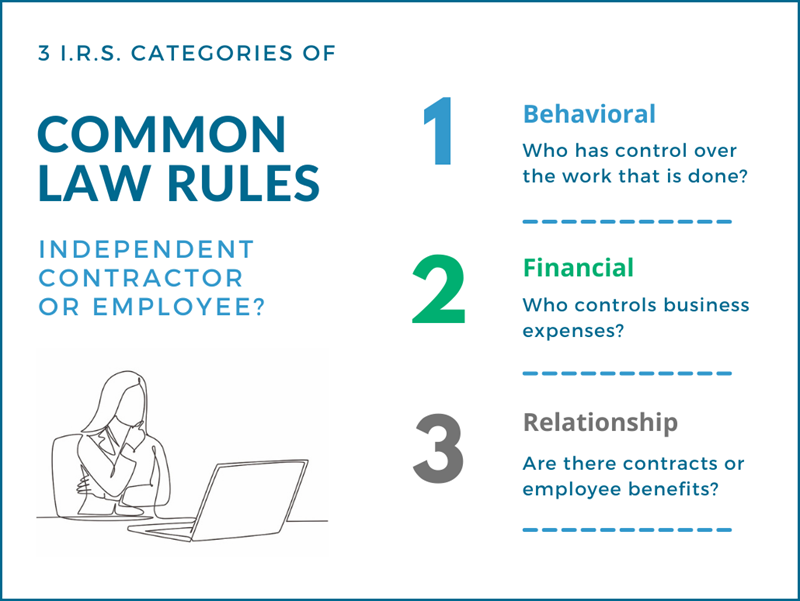

The Common Law Rules for evaluating an independent contractor (freelancer) versus an employee identifies three categories.

1. Behavioral

The behavioral category is one companies often stumble on. The following is language from the IRS guidance.

“Does the company control or have the right to control what the worker does and how the worker does his or her job?”

In the above examples, the LinkedIn ads appear to fail the behavioral test category for an independent contractor.

- The job requires the worker to be onsite or at a specific location.

- The ad sets working hours (available for all shifts).

Freelancers (independent contractors) set their own work hours/location. Companies cross the line from independent contractor to employee when they start dictating where, how, or when the person works.

2. Financial

Typically, the LinkedIn ads do not include the following information. However, if you are a job poster, consider the financial aspects of the open position.

“Are the business aspects of the worker’s job controlled by the payer? (these include things like how worker is paid, whether expenses are reimbursed, who provides tools/supplies, etc.)”

Presumably, if a job is onsite, then the computer, supplies and other materials are furnished by the company. If that is true, the company fails the financial category for independent contractor (freelancer).

3. Type of Relationship

This last category is another consideration for job posters.

“Are there written contracts or employee type benefits (i.e., pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business?”

I bet the job posters do not intend to offer employee benefits for many of these jobs. That’s why the freelancer word appears so attractive to them.

However, not offering benefits does not mean the company is home free. The other two Common Law Rules still apply.

Post Pandemic World

The global pandemic pushed an estimated two million Americans into freelancing. Many highly skilled professionals are opting out of employee status to remain independent.

Companies are struggling to find employees. Many are considering hiring independent contractors to fill the gap. So, understanding the consequences of misclassification is a big deal for companies. Potentially, a costly one.

Looming Legislation

If it’s not enough to learn IRS rules, now pending legislation may change the rules on independent contractors.

The PRO Act proposes a new set of rules for determining independent contractor status. The ABC Test offers three measurements that must be met to confirm independent contractor status.

Jennifer Mattern published an excellent guide on the PRO Act and its effect on the growing freelancer population. It’s a must read for freelancers. Another great source is following Jake Poinier on Twitter (@DrFreelance) who shares updated information on the PRO Act.

So, LinkedIn (and other) job posters, consider this word-defining post a Public Service Announcement.

- At a minimum, knowing who qualifies as an independent contractor cuts down on bad matches.

- Employers need to stay current on existing and pending legislation in determining status.

- Understanding the rules could save your business a whole lot of IRS or legal nightmares.

Perhaps (as one site suggested), we should eliminate the word freelancer and think in terms of independent contractor. What stories can you share about freelancer jobs that crossed the line?

==================

This June 28, 2021 post updates the original that posted on June 9, 2014.

Notice of Disclaimer

Cathy Miller is not an attorney and cannot provide legal or tax advice. The information provided is for your general background only and is not intended to constitute legal or tax advice as to your specific circumstances. We recommend you review legislation with legal counsel or your tax professional.

===================

Helping you Keep it simple, clear & uniquely yours.

=====================

Cathy, I hope lots and lots of employers read and understand this post of yours… thanks for writing it.

Thanks, Anne, 😉

It is more related to the degree of control that these companies feel they can exert. And, then leave their employees stranded to pick up the (tax) pieces they leave as detritus.

Unless and until we (as the potential suckers who agree to such mishandling) turn them in to the IRS, this practice will continue- and grow.

Call it my Pollyanna nature, Roy, but I believe more than a few simply do not understand the difference.

Thanks for sharing your point of view, Roy.

I can testify that the IRS is definitely concerned about misclassification of workers as independent contractors. I was contacted by the agency in the mid-2000s about all the work I’d been doing for a textbook publisher. I had to answer several questions to determine whether or not I was actually an employee. However, the publisher had done everything correctly and I was in fact an independent contractor.

Thanks, John, for sharing a very real experience. I’m glad your client had all their ducks in a row. 😉

Ah! Unforgettable days of early 1990’s!

Greece, Southern Europe:

The government takes on employees under the guise of ‘contracting’ them as ‘freelancers’.

This arrangement is much cheaper, and they can’t later claim a permanent post in the public administration. The gvt, essentially, adopts measures already practiced in the free market (short-term contracts, apprenticeship, etc) in order to cut back costs and obligations (as in, to either hire or to redo relevant legislation and mess up with a proven voter-seducing method).

How does this relate to the current situation in the States? You tell me; I only know that Kathy’s post triggered a memory, that’s all.

Curious to know whether your IRS does something against this practice. I don’t like it either.

I’m not familiar with what you’re describing, Helene. Here in the U.S., the problem (from the IRS perspective) is companies calling a worker an independent contractor but then treating them as an employee without paying income taxes or offering the worker benefits.

Seems my inclination not to pursue any “freelance” jobs that require working onsite was on target. Even if it was just because I didn’t want to leave home!

Doubly blessed, Paula. 😉

One of my former employers had a freelancer that they required to work on-site. I don’t know who dictated the hours, but she was in the office frequently. They might need a little schooling on what a freelancer is, too!

I am sure they are not alone in that, Ashley. It surprised me how many businesses don’t understand this concept. A bit scary, too. 😉 Thanks for sharing your example.

What a perfect time to revisit this gem. I plan to send a link to my Senators—who so far haven’t seemed to grasp the not-so-subtle difference between the IRS test for differentiating between freelancers/ICs and employees and the ABC Test, which dates back to the 1930s.

Unfortunately, there are a lot of confused people out there. Thanks for stopping by, Paula, and good luck with the Senators!

These sort of positions irk me beyond belief. The poster (who I would prefer calling an “imposter”) is trying to get away with having folks do work with no guarantees, no benefits, but in the functionality of an employee.

When I run across folks who come to me for tax advice in such “positions”, I routinely notify the IRS and the state employer board of the violations- which saves the pseudo-contractor a fair amount of money in taxes. (Too many folks think when the “earn” $ 35000 in “non-independent” independent contractor work, their tax bill will be $1000 or less, because of standard deduction and tax rates. Because they fail to see the requirement to pay employer taxes, which adds up to some $5000 in moneys due to the IRS!)

Thanks, Roy, for your expert take on this. It amazes me that it continues to be so prevalent. I don’t know if it’s more ignorance or the “imposter” characteristic you define. You would know better than me. Thanks again for sharing your thoughts.